We’ll leave it to the Quants to determine just how much revenue Amazon did during Prime Day 2023 (our clients saw anywhere from 2-7X daily sales during the event). We’re much more interested in the strategies Amazon used to boost engagement and increase the halo effect.

Let’s take a look at what Amazon did the same, what they changed, why, and how that affected the ecommerce space in general.

What Stayed the Same

Prime Day Announcement

Like usual, Amazon waited for as long as possible before announcing Prime Day. We all had an idea of when it was though, since Amazon started telling sellers to start replenishing inventory back in February or March.

Amazon only gave the internet 3 weeks this year to prepare, waiting until June 21st to announce the July 11-12 sales dates.

This guaranteed that unless you sent in inventory before Prime Day was announced, you wouldn’t get your shipment processed before the sale. It’s possible that part of the reason Amazon waits this long is to put pressure on sellers to stay on top of their inventory management and account health. You can’t fix an IPI score in three weeks.

But it’s likely a reason Amazon does this is to ensure hype doesn’t die down for the event. Everything is pandemonium during the three weeks before and during Prime Day. Bad for stress levels, great for sales.

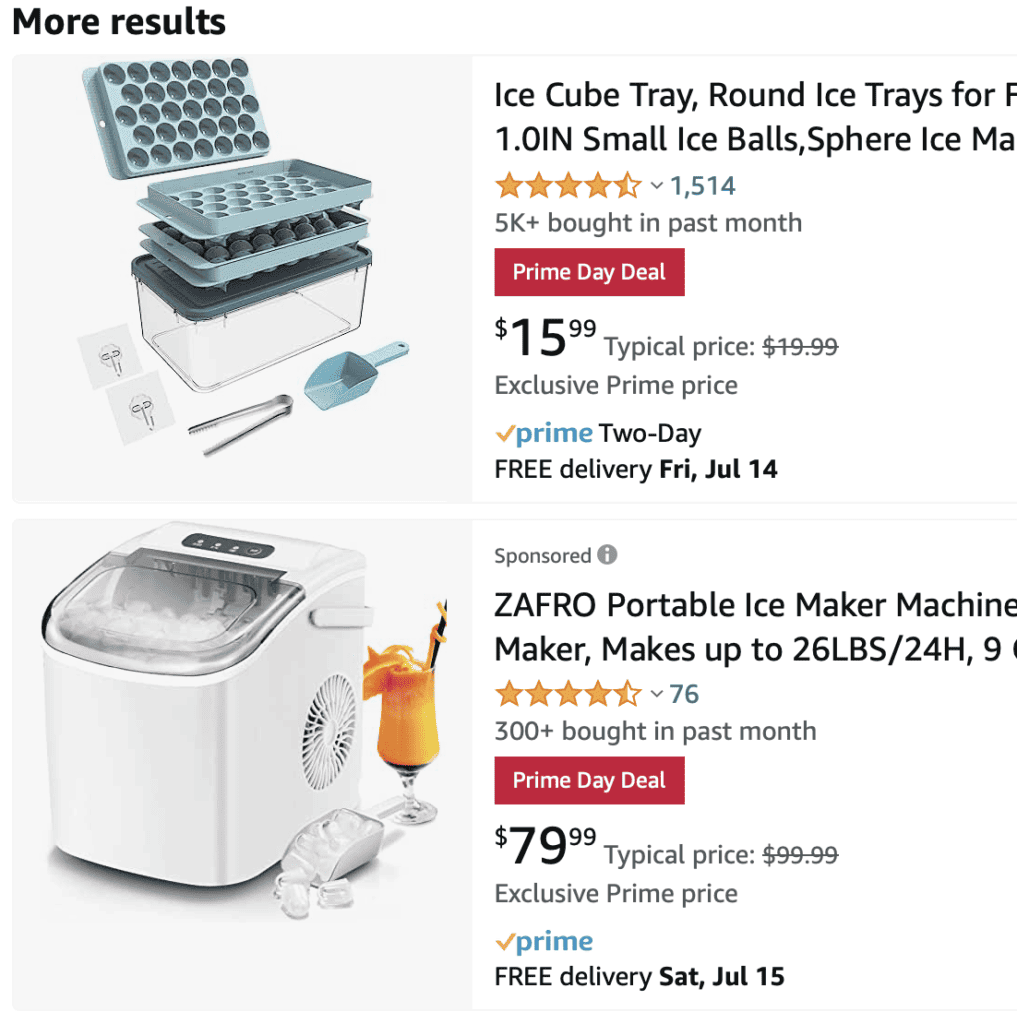

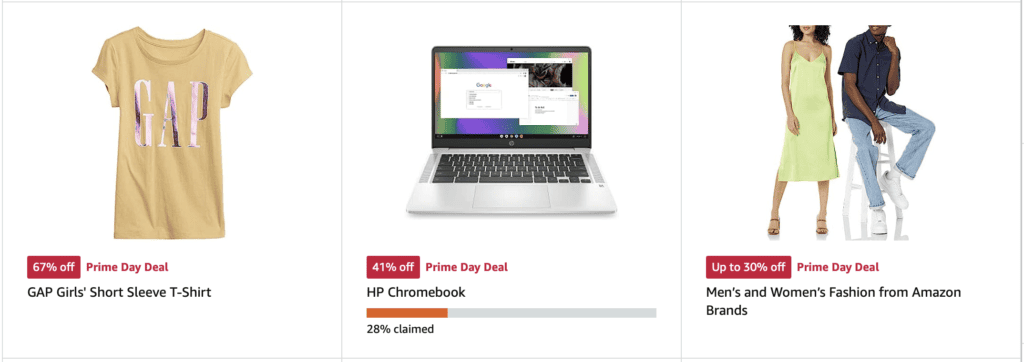

Lightning and Other Deals

By far, the kind of deal Amazon pushes the most is the Lightning Deal. These deals are invite-only, at least 20% off, and are usually only on highly rated products. Amazon thinks these are the best deals, so they push them the hardest.

Right in league with Lightning Deals are Deal of the Day (DotD) deals, and 7 Day Deals. These are also invite-only, and also only available to sellers in the SAS program.

As always, for sellers who weren’t involved in Lightning Deals, it was popular to see coupons and Prime Exclusive Discounts.

We don’t this is going to change much. Amazon will probably always push Lightning Deals, DotD, and 7 Day Deals the hardest. It’s that way both during and outside of sales events.

Increased Sales

Not every seller wants to run sales. And sometimes it’s best not to. Regardless, all of our clients saw an increase in sales, both organic and advertised.

Even for non-Prime sales (FBM products), sales increased drastically.

What this means is that every seller benefits from the increased customer intent that Amazon Prime Day brings.

What Changed

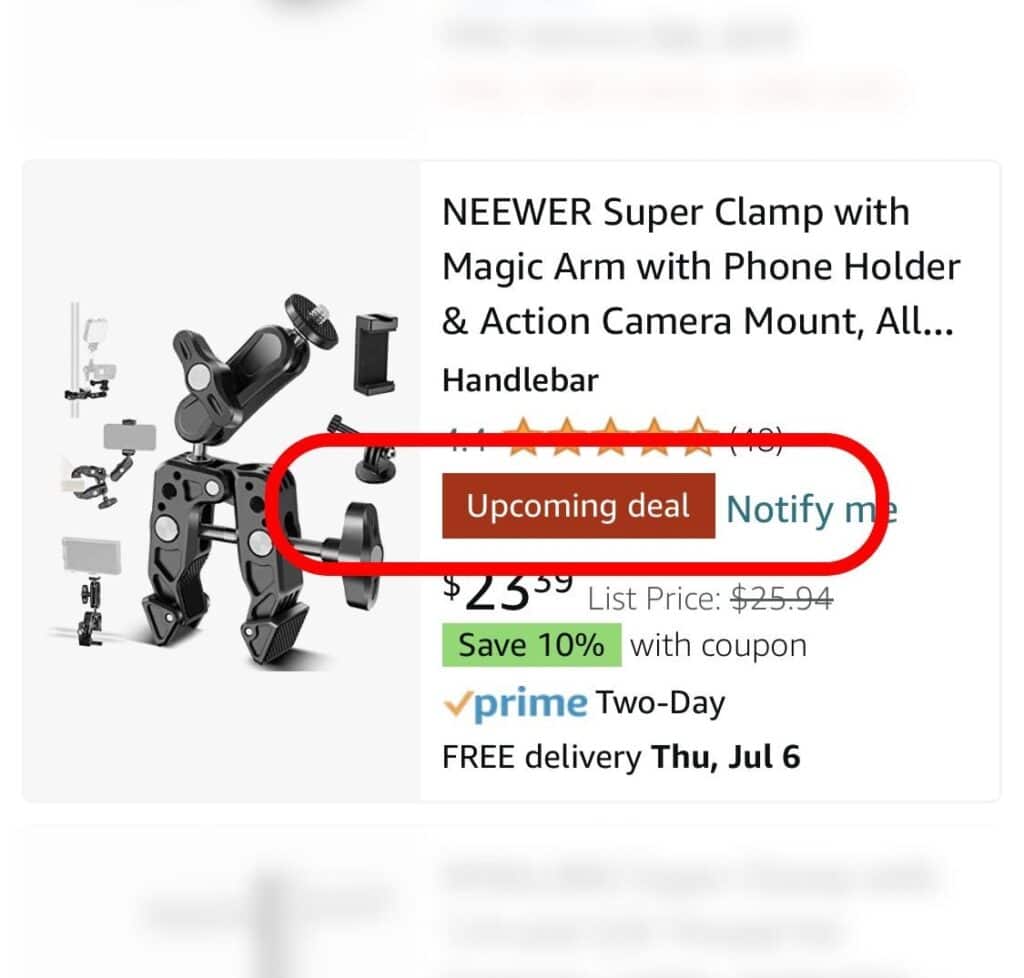

“Upcoming” Deals

Without a doubt, the biggest change Amazon made to how they handled Prime Day is the “upcoming” deals feature.

In the weeks leading up to Prime Day, Amazon started letting customers know which products would be on sale. This let customer plan out what they were going to purchase during Prime Day 2023.

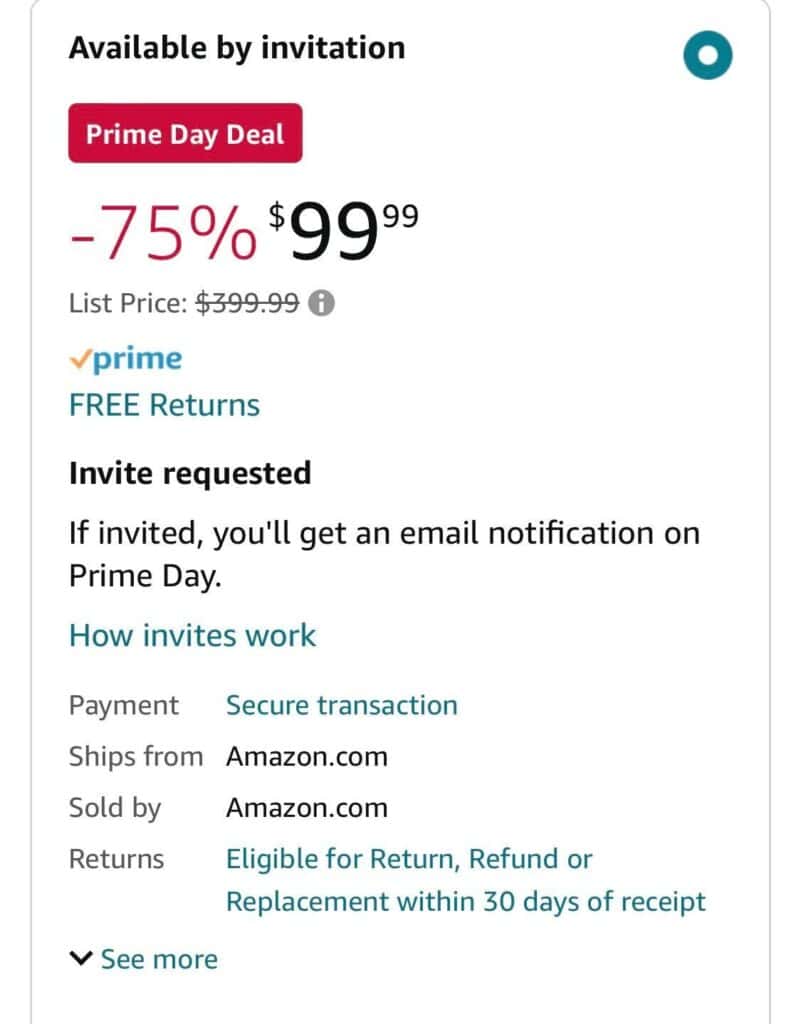

Amazon even went so far this year as to add “invite-only” deals. These are deals that customers had to sign up for, and then Amazon would email if they were selected to purchase the product.

A lot of these deals were super steep discounts. Like in the case of this 43″ 4K TV. Not everyone was about to access the 75% discount.

These upcoming deals create a rush to purchasing decisions. Customers sign up for deals, even if they aren’t sure if they want them. They add products to carts, even though they aren’t sure what the deal is. And generally speaking, customers spend a lot more time on the platform than they would otherwise.

This has a few benefits that we can see:

- The increased time on the platform leads to greater product exposure, even when customers don’t plan on purchasing anything. This is a phenomenal advertising tactic on Amazon’s part. Who knows–maybe you bought something anyway.

- Using the viewing, saving, and cart-adding history of a customer in the weeks leading up to Prime Day, Amazon’s able to customize the deals that customers see on Prime Day even better than before. They know exactly the kind of products you want because you’ve already told them.

- Amazon leverages this extra hype to capitalize on upsells. Since you’ve already added things to cart, you’re more likely to purchase–and the more likely you are to purchase, the more likely you are to purchase more.

Amazon still pushed sellers to offer deals and discounts in the weeks leading up to Prime Day, but they weren’t quite as concerned with building momentum as they were with building hype.

Our guess is that as a result, sales were pretty explosive this year for the platform. They always are, but they were likely more concentrated than before.

What this means for sellers is that there likely were not as many sales leading up to Prime Day 2023 as with previous years. Amazon wasn’t encouraging customer to buy so much as they were encouraging customers to shop.

We also think the halo effect of this strategy will be larger than previous years. Since customer buy more during Prime Day (instead of around Prime Day), the cart value of each customer is likely higher. The more a customer spends, the more comfortable a customer is to keep spending.

So even though sales leading up to Prime Day might have decreased, we think post-Prime Day sales will likely increase.

The Prime Exclusive Push

Each deal type has a different badge color. Lightning Deals are red, Coupons are green or orange, and Prime Exclusive Discounts are blue.

At least, generally speaking, that’s the case. But for Prime Day 2023, Amazon changed the color of the Prime Exclusive Discounts. For the sales event, they’re red.

Obviously, the red is more visible than the typical blue color for the badge. But we think that Amazon did this to make Prime Exclusive Discounts look more like Lightning Deals. And if you’re not looking closely, you might assume that any deal with a red badge is in fact a Lightning Deal. But it’s not.

The difference is, Lightning Deals, DotD, and 7 Day Deals have the discount inside the red badge itself.

This increase conversion rates for customers, but it blurs the line for sellers.

There are now legitimate reasons for sellers to not participate in Lightning Deals, and instead just leverage Prime Exclusive Discounts. After all, there’s not a “deal fee” associated with Prime Exclusive Discounts, and now they look almost exactly the same to the average customer. Additionally, you get to choose when your Prime Exclusive Discount runs, which is not the case with all deals.

Why do a Lightning Deal?

Of course, Amazon doesn’t push them as hard as Lightning Deals, and the discount amount isn’t quite as visible. But Lightning Deals aren’t quite as appealing as they used to be.

Other Platforms

Amazon has a massive effect in the ecommerce space. During Prime Day, Walmart, Target, eBay, Newegg, Steam (the video game marketplace), and a bunch of other brand websites all ran sales.

And they weren’t small sales.

There’s a network effect to all of this. Amazon has Prime Day and that increases customer purchasing intent. Then, other platforms run sales and that increases customer purchasing intent too. Sales grow everywhere. Sales are more effective when everyone does it.

As a result, this Prime Day was also the best to buy things off Amazon, as well as on Amazon.

What’s Next?

We think Amazon’s going to keep “upcoming” deal notifications in future Prime Days. We think this gives Amazon a lot of data and flexibility in the days and weeks leading up to Prime Day.

Amazon’s also making deal, discount, and promotion tools making more accessible to sellers, and we think they’ll continue to push Prime Exclusive Discounts with sellers.

Prime Exclusive Discounts serve as a pretty good litmus test for whether a seller or a product will make for a good Lightning Deal. Amazon gets an idea for how products perform, and that gives them data for future performance.

More and more, participation in Prime Day makes sense for all sellers–even smaller or more profit-focused sellers.

But regardless the strategy, at BLAZON, we’re here to make sure it goes off without a hitch.